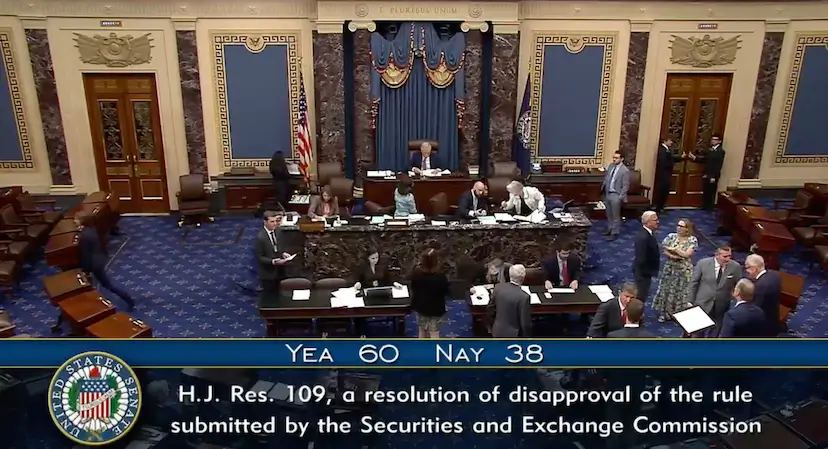

In a groundbreaking move towards fostering financial innovation and empowering the banking sector, the US Senate has passed a resolution overturning a significant crypto rule imposed by the Securities and Exchange Commission (SEC). This decision marks a pivotal moment in the evolving landscape of cryptocurrency regulation and its impact on traditional financial institutions.

The SEC’s rule, which aimed to restrict banks from engaging in certain cryptocurrency-related activities, had sparked heated debates within the financial industry and among policymakers. Proponents of the rule argued that it was necessary to protect investors and maintain the stability of the financial system, while critics viewed it as a barrier to innovation and a hindrance to the growth of the burgeoning crypto market.

The Senate’s resolution, which garnered bipartisan support, reflects a shift in attitudes towards cryptocurrencies and their potential role in shaping the future of finance. By overturning the SEC’s rule, lawmakers have signaled their willingness to embrace new technologies and adapt regulations to accommodate the changing landscape of digital assets.

One of the key arguments put forth by supporters of the resolution is the need to provide clarity and regulatory certainty for banks seeking to explore opportunities in the crypto space. By removing the restrictions imposed by the SEC, banks are now better positioned to leverage blockchain technology and digital assets to enhance their services and remain competitive in an increasingly digital world.

Moreover, the Senate’s decision sends a clear message that the US is committed to fostering innovation and maintaining its position as a global leader in finance. By allowing banks to actively participate in the crypto market, policymakers are paving the way for greater collaboration between traditional financial institutions and emerging fintech companies, ultimately driving growth and innovation across the industry.

The repeal of the SEC’s rule also highlights the importance of striking a balance between investor protection and promoting innovation. While regulatory oversight is crucial to safeguarding against potential risks and ensuring market integrity, overly restrictive measures can stifle creativity and impede progress in an ever-evolving industry.

Furthermore, the Senate’s action serves as a testament to the growing recognition of cryptocurrencies as legitimate financial assets with significant potential for reshaping traditional banking practices. By enabling banks to explore new avenues for growth and diversification through crypto-related activities, policymakers are embracing the transformative power of blockchain technology and digital currencies.

In addition to empowering banks, the resolution passed by the US Senate is expected to have far-reaching implications for the broader crypto ecosystem. As traditional financial institutions increasingly embrace cryptocurrencies, this move is likely to boost adoption rates among mainstream investors and pave the way for greater integration of digital assets into the traditional financial system.

Looking ahead, it will be crucial for regulators, industry stakeholders, and policymakers to continue collaborating on establishing clear guidelines and frameworks that balance innovation with prudential oversight. By fostering an environment that encourages responsible innovation and supports the growth of the crypto industry, the US can position itself as a hub for technological advancement and financial prosperity.

In conclusion, the US Senate’s decision to rescind the SEC’s crypto rule on banks represents a significant milestone in the ongoing evolution of cryptocurrency regulation and its impact on traditional finance. By embracing innovation and empowering banks to explore new opportunities in the crypto space, policymakers have taken a bold step towards shaping a more inclusive and dynamic financial ecosystem for the future.

[hfe_template id=’122′]

©2024. All Rights Reserved.