In the realm of finance, gold has long held a position of unrivaled prominence, serving as a benchmark for value and a safe haven for investors. However, the emergence of Bitcoin, the world’s first and most prominent cryptocurrency, has challenged this traditional narrative. Bitcoin’s rapid growth and increasing adoption have sparked a debate about its potential to supplant gold as a store of value and a hedge against inflation.

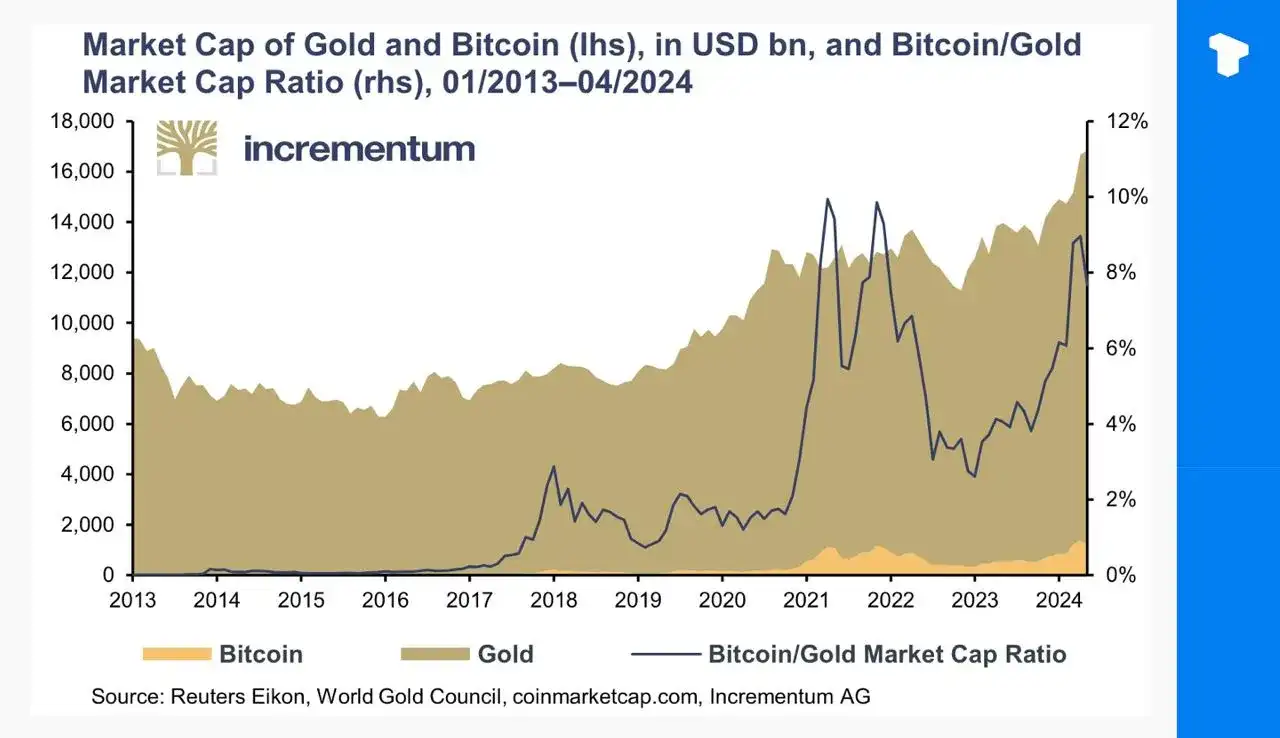

Bitcoin’s market capitalization has experienced a remarkable trajectory, soaring from a mere $1 million in its early days to over $1.4 trillion in May 2024. This meteoric rise has propelled Bitcoin into the ranks of the world’s most valuable assets, closing the gap with gold’s market capitalization of $16 trillion.

Several factors have contributed to Bitcoin’s remarkable growth:

Decentralization: Bitcoin’s decentralized nature, free from government or institutional control, appeals to investors seeking an alternative to traditional financial systems.

Scarcity: Bitcoin’s finite supply of 21 million coins contrasts with gold’s continuously increasing supply, making it an attractive asset for those seeking scarcity and potential appreciation.

Transparency: Bitcoin’s blockchain technology provides an immutable and transparent record of all transactions, enhancing its credibility and security.

Global Reach: Bitcoin’s borderless nature and accessibility to anyone with an internet connection have fueled its adoption worldwide.

While both Bitcoin and gold are considered valuable assets, they exhibit distinct characteristics:

Supply Dynamics: Bitcoin’s fixed supply stands in contrast to gold’s continuously increasing supply. This difference could impact their long-term price trajectories.

Intrinsic Value: Gold possesses inherent value as a precious metal used in jewelry and electronics, while Bitcoin’s value is derived from its network utility and perceived scarcity.

Government Regulation: Gold has a long history of acceptance by governments and central banks, while Bitcoin’s regulatory landscape remains uncertain and evolving.

Bitcoin’s rapid growth and increasing institutional adoption have led some analysts to predict a potential paradigm shift in the world of finance. They envision Bitcoin gradually eroding gold’s dominance as a store of value and a hedge against inflation.

Proponents of Bitcoin’s ascendency cite several factors:

Digital Native: Bitcoin’s digital nature aligns with the increasingly digital world, making it a more suitable asset for the 21st century.

Global Adoption: Bitcoin’s borderless nature and growing global acceptance could further propel its adoption and value.

Technological Advancements: Ongoing advancements in blockchain technology could enhance Bitcoin’s security, scalability, and adoption.

Despite its rapid growth, Bitcoin faces challenges that could hinder its path to becoming the dominant store of value:

Volatility: Bitcoin’s price volatility remains a significant concern for institutional investors.

Regulation: The evolving regulatory landscape surrounding cryptocurrencies could pose uncertainties.

Public Perception: Misconceptions and negative perceptions about Bitcoin could hinder its mainstream adoption.

Bitcoin’s emergence has undoubtedly challenged gold’s long-held position as the ultimate store of value. While Bitcoin’s rapid growth and increasing adoption are impressive, it remains to be seen whether it can fully displace gold’s dominance. The future of both assets will likely depend on factors such as technological advancements, regulatory developments, and public perception.

Diversification: Investors should consider diversifying their portfolios across various asset classes, including both Bitcoin and gold, to mitigate risk and potentially enhance returns.

Thorough Research: Before investing in Bitcoin or any cryptocurrency, it is crucial to conduct thorough research and understand the associated risks.

Responsible Investing: Investors should only invest what they can afford to lose and should exercise caution when making investment decisions.

The convergence of Bitcoin and gold presents an intriguing narrative in the world of finance. As Bitcoin continues to evolve and gain traction, the debate over its potential to supplant gold as the ultimate store of value will likely intensify, shaping the future of financial markets.

[hfe_template id=’122′]

©2024. All Rights Reserved.